UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

MANHATTAN ASSOCIATES, INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

|

|

|

| ||

(2) | Aggregate number of securities to which transaction applies: | |

|

|

|

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

| ||

(4) | Proposed maximum aggregate value of transaction: | |

|

|

|

| ||

(5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| (1) | Amount Previously Paid: |

|

|

|

| ||

(2) | Form, Schedule or Registration Statement No.: | |

|

|

|

| ||

(3) | Filing Party: | |

|

|

|

| (4) | Date File |

|

|

|

|

|

|

|

2 |

| |

| |

|

|

| |

| |

| |

| |

| |

| |

|

|

Security Ownership of Certain Beneficial Owners and Management |

|

Delinquent Section 16(a) |

|

| |

|

|

Proposal 2 – Resolution to Approve Named Executive |

|

| |

| |

| |

| |

| |

| |

| |

|

|

Proposal 3 – Ratification of Appointment of Independent Registered Public Accounting Firm |

|

| |

| |

|

|

Additional Information about the Annual Meeting of Shareholders |

|

| |

| |

| |

| |

| |

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 17, 201813, 2021

Manhattan Associates Corporate Headquarters

2300 Windy Ridge Parkway, Atlanta, Georgia 30339

(770) 955-7070

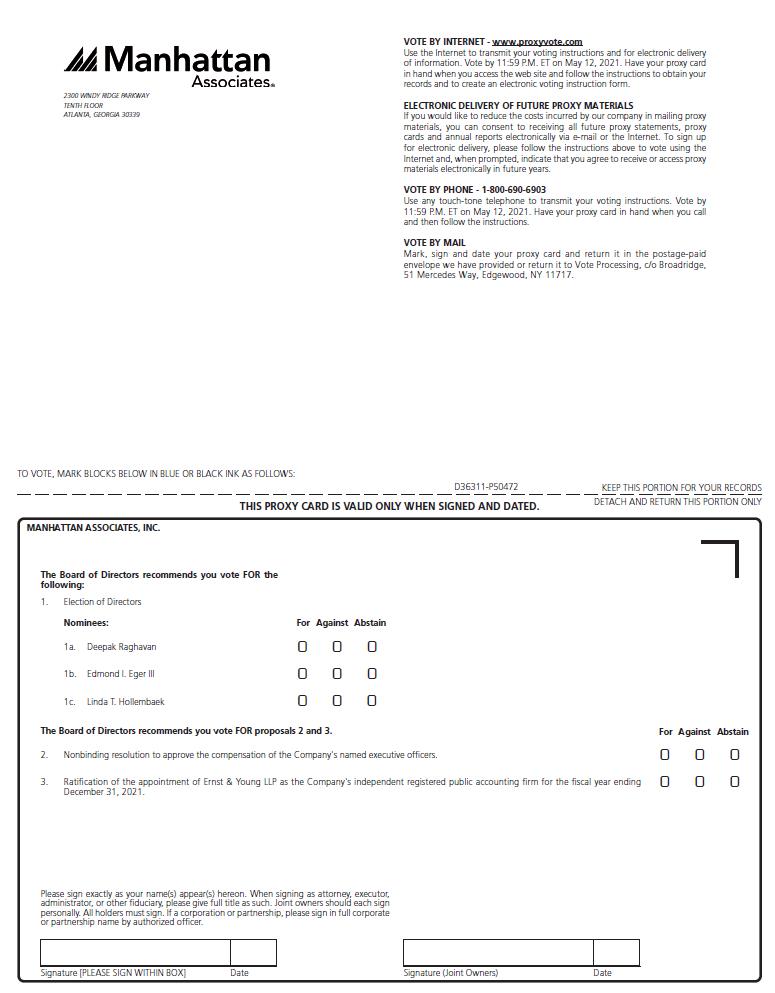

NOTICE IS HEREBY GIVEN that the 20182021 Annual Meeting of Shareholders of Manhattan Associates, Inc. (the “Company,” “our,” “we” or “us”) will be held at 2300 Windy Ridge Parkway, Atlanta, Georgia 30339, at 9:00 a.m., Atlanta, GeorgiaEastern time, on Thursday, May 17, 201813, 2021 (the “Annual Meeting”), to consider and act upon:

| 1. | the election of three Class II Directors to the Company’s Board of Directors; |

| 2. | a nonbinding resolution to approve the compensation of the Company’s named executive officers; |

| 3. | a proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, |

| 4. | such other business as may properly come before the Annual Meeting or any adjournment of the meeting. |

The Board of Directors has fixed the close of business on March 21, 2018,19, 2021, as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. For instructions on voting, please refer to the notice you received in the mail or, if you requested a hard copy of the proxy materials, on your enclosed proxy card.

| By Order of the Board of Directors, |

|

|

|

|

| Bruce S. Richards |

| Senior Vice President, Chief Legal Officer and Secretary |

April 4, 2018March 31, 2021

Atlanta, Georgia

We intend to hold the Annual Meeting in person, but we continue to monitor developments regarding the COVID-19 pandemic. Accordingly, it could become necessary to change the date, time, location or means of holding the meeting. If we determine that it is not possible or advisable to hold our Annual Meeting as currently planned, we will announce our change of plan in a press release, post the details on our website, and file the details with the SEC as proxy materials. If you plan to attend our Annual Meeting, please check our website the week of the meeting. As always, we encourage you to vote your shares prior to the meeting.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, PLEASE SUBMIT YOUR VOTE THROUGH THE INTERNET OR BY TELEPHONE, OR IF YOU REQUESTED PAPER COPIES OF THE PROXY MATERIALS, YOU MAY VOTE BY MAIL BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. NO POSTAGE IS REQUIRED

2

FOR MAILING IN THE UNITED STATES. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 17, 201813, 2021

This proxy statement, the form of proxy and annual report on Form 10-K for the fiscal year ended December 31, 20172020 (“20172020 Annual Report”) are being mailed to shareholders who have requested hard copies on or after April 4, 2018.March 31, 2021. Registered and beneficial shareholders may view and print this proxy statement and the Company’s 20172020 Annual report at www.proxyvote.com or in the Investor Relations section of the Company’s web site at www.manh.com.

2  3

3

This summary highlights information contained elsewhere in this Proxy Statement. For more information, please read our Annual Report on Form 10-K for fiscal year 20172020 and the entire Proxy Statement prior to voting.

ANNUAL MEETING OF SHAREHOLDERS |

Date and Time: | May |

Place: | Manhattan Associates Headquarters, 2300 Windy Ridge Parkway, Atlanta, GA 30339 |

Record Date: | March |

By Internet: Go to www.proxyvote.com;

By phone: Call 1-800-690-6903;

By mail: Call 1-800-579-1639 to request a paper copy of the materials and follow the instructions on your proxy materials; or

In person by attending the Annual Meeting of Shareholders.

To cast your vote by internet or phone, you will need the control number from your proxy card or the notice to our shareholders. We intend to hold the Annual Meeting in person, but we continue to monitor developments regarding the COVID-19 pandemic. Accordingly, it could become necessary to change the date, time, location or means of holding the meeting. If we determine that it is not possible or advisable to hold our Annual Meeting as currently planned, we will announce our change of plan in a press release, post the details on our website, and file the details with the SEC as proxy materials. If you plan to attend our Annual Meeting, please check our website the week of the meeting. As always, we encourage you to vote your shares prior to the meeting. |

|

4

MEETING AGENDA AND VOTING MATTERS |

Proposal | Proposal |

| Recommendation of the Board |

| Voting Standard |

| Page Number (for more details) | Proposal |

| Recommendation of the Board |

| Voting Standard |

| Page Number (for more details) |

1. | Election of three Class II Directors, each for a three-year term expiring in 2021. |

| FOR (each nominee) |

| Plurality of the votes cast, subject to policy requiring a nominee who is elected with less than a majority of the votes cast to offer to resign |

| 10 | Election of three Class II Directors, each for a three-year term expiring in 2024. |

| FOR (each nominee) |

| Plurality of the votes cast, subject to policy requiring a nominee who is elected with less than a majority of the votes cast to offer to resign |

| |

2. | Advisory vote to approve the compensation of our named executive officers. |

| FOR |

| Votes cast in favor exceed votes cast against |

| 23 | Advisory approval of the compensation of our named executive officers. |

| FOR |

| Votes cast in favor exceed votes cast against |

| |

3. | Ratification of appointment of Ernst & Young, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018. |

| FOR |

| Votes cast in favor exceed votes cast against |

| 42 | Ratification of appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021. |

| FOR |

| Votes cast in favor exceed votes cast against |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35

|

|

|

|

|

| Committee Memberships |

|

|

|

|

|

|

| Committee Memberships | ||||||

Name, Primary Occupation | Age | Director Since | Current Term Expires | Expiration of Term For Which Nominated | Independent | Other Public Company Boards | Audit | Compensation | Nomination & Governance | Age | Director Since | Current Term Expires | Expiration of Term For Which Nominated | Independent | Other Public Company Boards |

| Audit | Compensation | Nomination & Governance | |

Eddie Capel President and CEO of Manhattan Associates, Inc. | 57 | 2012 | 2020 | - | No | None |

| 60 | 2012 | 2023 | - | No |

| 1 |

|

| ||||

Edmond I. Eger III CEO of Rewards Network Establishment Services, Inc. | 57 | 2015 | 2018 | 2021 | Yes | None | ✓ | 60 | 2015 | 2021 | 2024 | Yes | None |

| ü |

|

| |||

John H. Heyman CEO of SnapAV and Partner of Actuate Partners, LLC | 56 | 2016 | 2019 | - | Yes | None | ✓ | |||||||||||||

Linda T. Hollembaek Senior Vice President, Integration Management Officer of Lexmark International, Inc. (Retired) | 63 | 2018 | 2021 | 2024 | Yes | None |

|

| ü | |||||||||||

John J. Huntz, Jr. (Chairman) Managing Director of Huntz & Co., LLC | 67 | 1999 | 2019 | - | Yes | None | Chair | ✓ | 70 | 1999 | 2022 | - | Yes | None |

| Chair | ü | |||

Charles E. Moran Chairman and CEO of Skillsoft Corporation (retired) | 63 | 2017 | 2020 | - | Yes | None | ✓ | |||||||||||||

Thomas E. Noonan Partner of TechOperators, LLC; Chairman of Iconic Security, Inc. and TEN Holdings, LLC | 57 | 1999 | 2019 | - | Yes | 1 | ✓ | Chair |

| |||||||||||

Charles E. Moran Chairman and CEO of Skillsoft Corporation (Retired) | 66 | 2017 | 2023 | - | Yes |

| 2 |

|

| ü |

| |||||||||

Thomas E. Noonan General Partner of TechOperators, LLC; | 60 | 1999 | 2022 | - | Yes |

| 1 |

| ü | Chair |

| |||||||||

Deepak Raghavan Adjunct Professor at Georgia State University | 51 | 1998 | 2018 | 2021 | Yes | None |

| Chair | 54 | 1998 | 2021 | 2024 | Yes | None |

|

| Chair | |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Number of Members | Independent | Number of Meetings During Fiscal Year | Number of Members | Independent | Number of Meetings During Fiscal Year |

Full Board | 7 | 86% | 5 | 7 | 86% | 6 |

Audit Committee | 3 | 100% | 4 | 3 | 100% | 4 |

Compensation Committee | 3 | 100% | 6 | 3 | 100% | 6 |

Nomination & Governance Committee | 3 | 100% | 4 | 3 | 100% | 5 |

6

|

WeAs we continue to transition to a cloud-first company, we believe 20172020 was a year of substantial progress in positioning the Company for future long-term sustainable growth. Entering 2021, we remain focused on driving revenue growth and gaining market share. We note however our objectives for the year are subject to a number of risks and uncertainties, including the ongoing effects of the novel coronavirus disease (“COVID-19”) pandemic on global commerce, as well as the other factors set forth in a challenging retail environment.Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. We are confident in our long-term strategy driven by our market leadership in innovative supply chain and omnichannel solutions and services.

Among ourOur accomplishments we:include:

Continued to investAggressively investing in innovation and sought to expand ourexpanding total addressable market

| ✓ |

|

| ✓ | In May 2020, we launched our cloud-native Manhattan Active® Warehouse Management Solution, which we believe is the most advanced warehouse management system released in over a decade. The market reaction to this new product has been impressive with a double-digit number of deals closed to date and a growing pipeline. |

✓ | Our Manhattan Active® Solutions |

| ✓ |

|

4

ExecutedRevenue and earnings performance was solid in a businessthe 3rd year of cloud transition and challenging retail macro environment

| ✓ | Total revenue was |

| ✓ | GAAP diluted EPS was $1.36, up 3% versus 2019, while Adjusted EPS was $1.76, up 1% versus 2019, reflecting our expense management. |

✓ | Customer retention rates were well above 90% |

| ✓ |

|

| ✓ | Recurring revenue as a percentage of total revenue, excluding hardware sales, rose from |

| ✓ |

|

✓ | 2020 GAAP operating margin of |

Maintained capital discipline and financial capacity

| ✓ | We closed |

| ✓ | Operating cash flow was |

| ✓ | In response to COVID-19, we took proactive measures to position the Company for uncertainty in the near-term. Those actions, effective April 1, 2020, included reduction of officer salaries and board of directors’ fees, suspension of our 401(k) plan company match, and suspension of our share repurchase program, all for the balance of 2020. |

✓ | We invested |

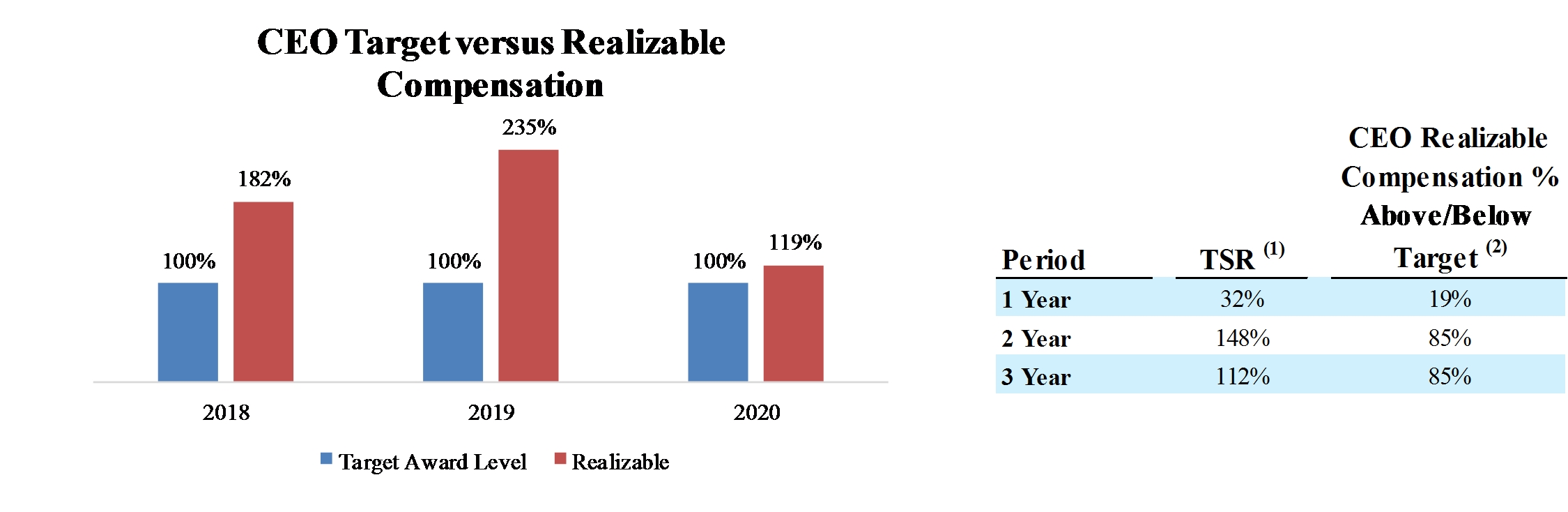

Our 2017 performance was influenced by delays in large investments in supply chain software by retail customers coupled with accelerated market adoption ofIn 2020, we exceeded our cloud-based subscription services, and its correlative negative effecttarget objectives (as defined on up-front revenue recognition when compared to traditional perpetual software licenses.page 32 As a result, we did not achieve our consolidated revenue objective) for our annual cash bonus program and the performance-based component of our long-term equity (restricted stock unit) program, resulting in a reduced payout of 49% of the target payout to the named executive officers forunder our annual cash bonus program of 108% of target to all participants including our NEOs, and a 0% payout toearned performance-based equity under the named executive officers forperformance-based component of our 2017 performance-based2020 long-term equity program grants.at 108% of target for all participants including our NEOs.

Our total shareholder return (“TSR”) for 2017 was negative seven percent (-7%). Based on the Company’s stock price at December 31, 2017,

our CEO’s compensation was down 43%, and our NEO’s compensation collectively down 37% versus their 2017 compensation targets. Despite our TSR, the 7

The Board of Directors believes that the Company made substantial progress toward positioning the Company for long-term success, expanding its addressable market through meaningfully differentiated investment in innovation, and positioning Manhattan Associates for potential long-term sustainable growth.

CORPORATE RESPONSE TO COVID-19 |

Regarding the impact of the COVID-19 pandemic, we remain cautious about the global recovery, which we expect to be slow and protracted. In 2020, we experienced solid demand for our cloud-based supply chain and omnichannel commerce solutions, and our competitive win rates remain strong. We had no notable cancellations in 2020.

We have taken steps to best protect the health and safety of our employees globally. Our daily execution has evolved largely into a virtual model, but we believe we have been successful in maintaining our ability to effectively communicate with and service our customers and customer prospects during the pandemic period.

In April 2020, we took proactive actions to manage operating expenses and cash flow, including reduction of officer salaries and board of directors’ fees, suspension of our 401(k) plan company match, and suspension of our share repurchase program. Those actions did not materially impact our ability to support our customers or make key investments in research and development to further extend our competitive positioning. We continue to monitor and aggressively manage operating expenses globally. We also will continue to actively monitor the situation and may take further actions that modify our business operations as may be required by federal, state or local authorities or that we determine are in the best interests of our employees, customers, and partners.

CORPORATE GOVERNANCE HIGHLIGHTS |

Governance Matter | Summary Highlights | |

Board Independence |

| Independent Board of Directors, except Chief Executive Officer |

|

| Fully independent Board committees |

|

| Separate Chairman and Chief Executive Officer roles |

Director Elections |

| Majority Vote Resignation Policy |

Meeting Attendance |

| All Directors attended 100% of total number of Meetings of Board and Committees on which the Directors served in |

Evaluating and Improving Board |

| Commitment to Board Refreshment |

Performance |

| Major Board assessments every three years |

|

| Annual self-assessments of Committees |

Aligning Director and Shareholder |

| Non-executive Director minimum share ownership guidelines |

Interests |

| Annual Director equity awards |

Aligning Executive Officer and |

| Executive officer minimum share ownership guidelines |

Shareholder Interests |

| Executive compensation driven by pay-for-performance philosophy |

Other |

| Annual shareholder advisory ("say-on-pay") vote |

|

| Regular Board review of enterprise risk areas |

|

| Director Status Change Resignation Policy |

|

| Prohibition on pledging and hedging of Company securities |

8

5

Base Salaries

| ✓ |

|

| ✓ |

|

|

|

Annual Cash Bonus

| ✓ | Our annual cash bonus program was based on three performance measures: Target Revenue, new annual contract value from cloud-based services (NACV) and adjusted operating income (AOI), all as defined on page 33. Based on our |

Long-term Incentive Compensation

| ✓ | Our 2020 long-term equity grants to our NEOs were 50% service-based RSUs and 50% performance-based RSUs with three performance measures: Target Revenue, NACV, and AOI. Based on our |

|

|

|

|

|

|

|

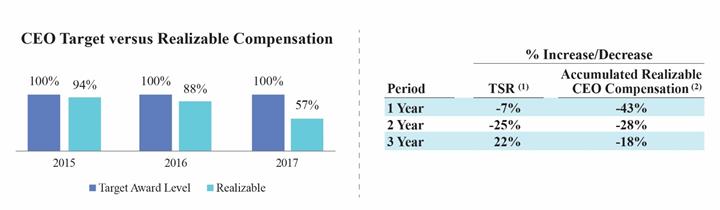

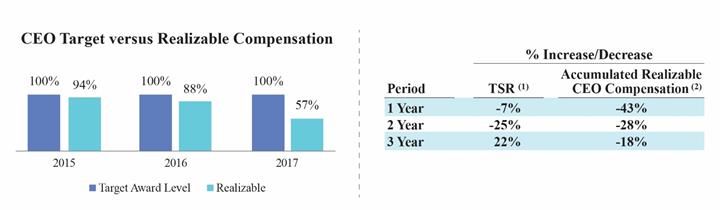

CEO Target Versus Realizable Compensation

The “Target” bars represent Mr. Capel’s base salary, target annual cash bonus, and grant-date target value of long-term incentive awards for 2015, 2016, and 2017. The “Realizable” bars represent, as a percentage of target, the total of each year’s base salary paid, annual cash bonus earned and long-term incentive award value as of December 31, 2017.

|

|

|

|

Mr. Capel’s accumulated compensation for the past three years had an intended grant-date value of approximately $12.7 million. Based on the Company’s stock price at December 31, 2017 and the Company’s performance for the past three years, the realizable value of this compensation was approximately $10.4 million, which was 18% below their intended target value. By design, our executive compensation program will not deliver the intended target value unless the Company meets or exceeds its applicable financial performance targets.

6

Named Executive Officer Compensation

The following table sets forth the total compensation paid or earned by the Company’s named executive officersNEOs in 20172020 as determined under SEC rules. For more details, please see Compensation Discussion and Analysis starting on page 2426 and the 20172020 Summary Compensation Table and its accompanying notes on page 35.39.

Name and Principal Position | Salary | Stock Awards |

| Non-Equity Incentive Plan Compensation |

| All Other Compensation | Total | Salary | Stock Awards |

| Non-Equity Incentive Plan Compensation |

| All Other Compensation | Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eddie Capel | $575,000 | $2,430,742 |

| $281,750 |

| $43,845 | $3,331,337 | $503,750 | $5,295,282 |

| $669,600 |

| $45,410 | $6,514,042 |

President, Chief Executive |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Officer, and Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dennis B. Story | 391,167 | 875,085 |

| 140,140 |

| 21,856 | 1,428,248 | 380,738 | 1,613,868 |

| 345,600 |

| 30,822 | 2,371,028 |

Executive Vice President, Chief |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Officer, and Treasurer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bruce S. Richards | 309,167 | 437,568 |

| 87,710 |

| 18,826 | 853,271 | 338,000 | 585,056 |

| 211,680 |

| 28,808 | 1,163,544 |

Senior Vice President, Chief |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal Officer, and Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert G. Howell | 308,250 | 875,085 |

| 147,000 |

| 30,902 | 1,361,237 | 344,000 | 1,260,832 |

| 367,200 |

| 30,366 | 2,002,398 |

Senior Vice President, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Linda C. Pinne | 245,750 | 121,553 |

| 40,261 |

| 8,100 | 415,664 | 263,345 | 211,822 |

| 99,544 |

| 3,819 | 578,530 |

Senior Vice President, Global Corporate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Controller, and Chief Accounting Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

79

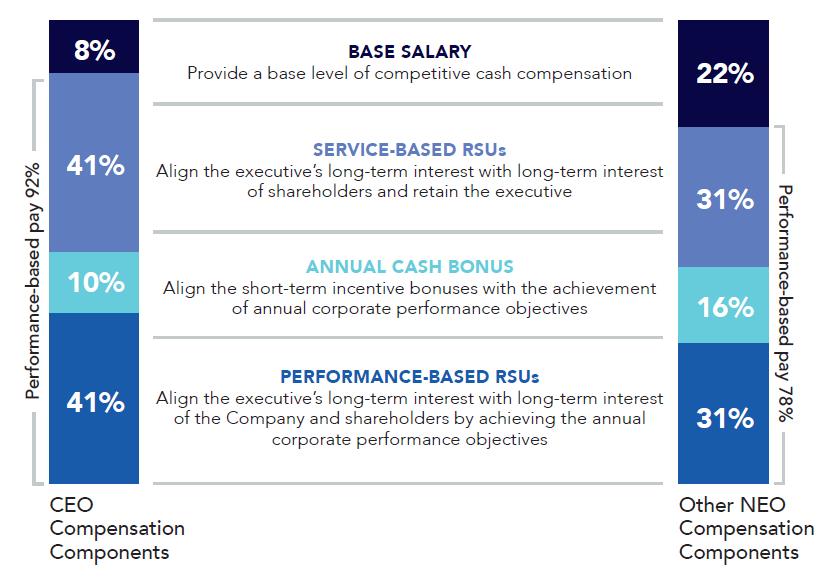

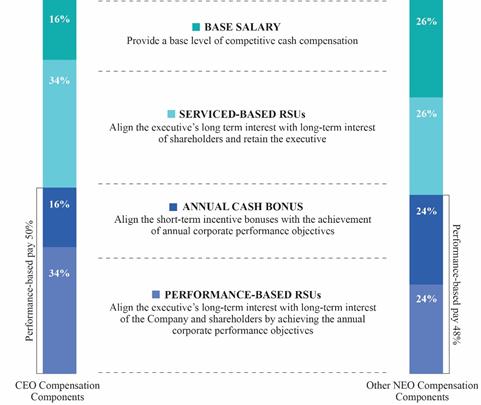

Components of Target Compensation for 20172020

Our executives’ target compensation for 20172020 consisted of the components described below.below (1).

| (1) | The above chart includes base salary earned in 2020, target short-term incentive opportunities, and the grant date value of annual equity awards. |

With approximately 50%80% of performance-based pay, we believe our current executive compensation program directly links executive compensation to our financial performance and alignaligns the interests of our executive officers with those of our shareholders. We believe our executive compensation programs provide our executive officers with a balanced compensation package that includes a reasonable base salary along with annual and long-term incentive compensation opportunities based on our performance against pre-established financial performance objectives. This strong alignment between our financial results, shareholder returns, and executive compensation is the cornerstone of our executive compensation philosophy and program design. See page 2831 for more information.

810

2300 Windy Ridge Parkway, Tenth Floor

Atlanta, Georgia 30339

Annual Meeting of Shareholders

May 17, 201813, 2021

Information Concerning Solicitation and Voting

annual meeting of Shareholders |

This Proxy Statement (“Proxy Statement”) is furnished on behalf of the Board of Directors (the “Board”) of Manhattan Associates, Inc., a Georgia corporation (the “Company,” “our,” “we” or “us”), to solicit proxies for use at the Annual Meeting of Shareholders to be held on Thursday, May 17, 2018,13, 2021, at 9:00 a.m., Atlanta, Georgia,Eastern time (the “Annual Meeting”), or at any adjournment or postponement of the meeting, for the purposes set forth in this statement and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at 2300 Windy Ridge Parkway, Atlanta, Georgia 30339.

We intend to hold the Annual Meeting in person, but we continue to monitor developments regarding the COVID-19 pandemic. Accordingly, it could become necessary to change the date, time, location or means of holding the meeting. If we determine that it is not possible or advisable to hold our Annual Meeting as currently planned, we will announce our change of plan in a press release, post the details on our website, and file the details with the SEC as proxy materials. If you plan to attend our Annual Meeting, please check our website the week of the meeting. As always, we encourage you to vote your shares prior to the meeting.

Internet Availability of Proxy Materials

The Company is following the Securities and Exchange Commission (the “SEC”) “Notice and Access” rule that allows companies to furnish their proxy materials over the Internet. As a result, instead of mailing a paper copy of the proxy materials, which include this Proxy Statement, proxy card, and our Annual Report on Form 10-K for the fiscal year ended December 31, 20172020 (the “2017“2020 Annual Report”), the Company intendswe intend to mail, beginning on April 4, 2018,March 31, 2021, a notice to our shareholders (the “Notice”) notifying them that those materials are available on the Internet beginning April 4, 2018,March 31, 2021, how our shareholders may access them over the Internet, and how to request a paper or email copy. There is no charge for requesting a paper or email copy.

Registered and beneficial shareholders may view and print this Proxy Statement and the 20172020 Annual Report at www.proxyvote.com or in the Investor Relations section of our web site at www.manh.com.

How to Vote

The Notice contains instructions on how to vote online, by mail (if you request a paper copy of proxy materials), or in person. You may also vote by calling 1-800-690-6903 or the number on the proxy card. You will need the control number from your proxy card or the Notice.

Shareholders Entitled to Vote

Only holders of record of the Company’s common stock, $0.01 par value per share (“Common Stock”), at the close of business on March 21, 201819, 2021 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. At the close of business on the Record Date, the Company had 66,819,43163,616,713 shares of Common Stock outstanding and entitled to.to vote. Each holder of record of Common Stock on that date will be entitled to one vote for each share held on all matters to be voted on at the Annual Meeting.

911

Proposal 1 – Election of Class II Directors

The Board of Directors has seven members divided into three classes. The term of each Director is three years, and the terms of the Directors are staggered by class. The Board currently comprises two Class I Directors (Messrs. Capel and Moran), whose terms expire in 2020, two2023, three Class II Directors (Messrs. Raghavan and Eger)Eger, and Ms. Hollembaek), whose terms expire at the Annual Meeting, and threetwo Class III Directors (Messrs. Huntz Heyman, and Noonan), whose terms expire in 2019.2022. On the Nomination and Governance Committee’s recommendation, the Board has nominated Messrs. Raghavan and Eger, and Ms. Hollembaek, for re-election as Class II Directors, and Linda T. Hollembaek for election as a new Class II Director. Onwhich will become effective at the election of the three Class II Director nominees, the Board’s size will increase to eight members.Annual Meeting. There are no family relationships among our Directors or Director nominees.

Shares represented by executed proxies will be voted for the election of the nominees named below, unless the authority to do so is withheld. If any nominee unexpectedly becomes unavailable for election, the individuals acting as proxies may exercise their discretion to vote for the election of the Board’s substitute nominee. The individuals nominated for election at the Annual Meeting have agreed to serve if elected, and the Board has no reason to believe that they will be unable to serve.

✓ | THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE NAMED NOMINEES. |

Board of Directors and Committees

director Nominees

Set forth below are our nominees to serve as Class II Directors (terms expire in 2021)2024).

Deepak Raghavan

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

Adjunct Professor at Georgia State University | 51 | 1998 | 2018 | ✓Nomination & Governance (Chair) | None | ✓Business operations ✓Business development and corporate transformation ✓Corporate governance ✓Supply chain management ✓Technology and software industries | ||||||

Lecturer and Adjunct Professor at Georgia State University | 54 | 1998 | 2021 | ✓Nomination & Governance (Chair) | None | ✓Business operations ✓Business development and corporate transformation ✓Corporate governance ✓Supply chain management ✓Technology and software industries | ||||||

Biography

Deepak Raghavan, age 51,54, a co-founder of the Company, has served as a member of our Board since February 1998. Dr. Raghavan conceptualized, designed and developed the Company’s PkMS® solution—the industry's first "packaged" supply chain execution system. Dr. Raghavan served as our Senior Vice President - President—Product Strategy from January 2001 until June 2002, as Senior Vice President and Chief Technology Officer from August 1998 until January 2001, and as Chief Technology Officer from our inception in October 1990 until August 1998. From 1987 until 1990, Dr. Raghavan served as a Senior Software Engineer for Infosys Technologies Limited, a software development company, where he specialized in the design and implementation of information systems for the apparel manufacturing industry. Dr. Raghavan earned a Civil Engineering degree from the Indian Institute of Technology, New Delhi, in 1987, an executive MBA degree from Georgia State University in 1998, and a Ph. D. degree in Astronomy from Georgia State University in 2009, and2009. He is currently anlecturer and adjunct professor at Georgia State University.

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

Dr. Raghavan has been an officer of the Company or member of our Board since its inception, and during that time has helped guide the Company through its transformation from a small private software and services company to a growing public company. With over 20approximately 30 years of experience with the Company, Dr. Raghavan brings deep institutional knowledge and perspective to our Board regardingabout our strengths, challenges, and opportunities, as well as significant industry experience. As chairman of our Nominations and Governance Committee, Dr. Raghavan’s principled leadership is reflected in numerous

1012

committee achievements, including recommending, and then establishing, a process for regular Board meeting presentations and discussions on material company risk areas; adoption of our Majority Voting Director Resignation Policy; adoption of our Director Status Change Resignation Policy; and championing the committee’s recent Board recruiting efforts yielding our first female Board nominee. Dr. Raghavan’s skills and perspectives also have best positioned him to oversee new Director onboarding and other Board transitions.

Edmond I. Eger III

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

CEO of Rewards Network Establishment Services, Inc. | 57 | 2015 | 2018 | ✓Compensation | None | ✓Business operations ✓Corporate governance ✓International operations ✓Leadership - current CEO ✓Financial industries | 60 | 2015 | 2021 | ✓Audit | None | ✓Business operations ✓Corporate governance ✓International operations ✓Leadership - current CEO ✓Financial industries |

Biography

Edmond I. Eger III, age 57,60, has served as a member of our Board since October 2015. Since September 2017, Mr. Eger has served as the Chief Executive Officer and member of the Board of Directors of Rewards Network Establishment Services, Inc., which helps restaurants increase their revenue, traffic, and customer engagement through their innovative financial and marketing services. From December 2013 through January 2017, Mr. Eger served as the President and Chief Executive Officer of OANDA Corporation, a leader in online foreign exchange and over-the-counter commodities and indices trading services. From 2009 to 2013, he served as a Senior Vice President and General Manager for the Americas at PayPal, Inc., and as an advisor to the CEO at eBay Corporation. From 1999 to 2009, Mr. Eger held various management positions with Citigroup and last served as the CEO for its International Cards Business. Prior to joining Citigroup, his experience included various business management positions with Advanta, Standard Chartered Bank, Wells Fargo, and McKinsey & Company. From September 2013 to February 2015, he served on the Board of Directors at Digital River, Inc., a Nasdaq traded e-commerce and payment provider, which was sold to Siris Capital.

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

Mr. Eger is a leader in the payments and consumer transactions sectors, with over 25 years ofwide-ranging experience, and has extensive knowledge of international business. He is a seasoned international payments executive with deep financial services, management, branding, and risk management experience. We believe Mr. Eger’s extensive knowledge and leadership experience bringsbring valuable perspective to the BoardBoard. Mr. Eger’s familiarity and the Compensationexperience with audit committee and finance matters at public companies qualify him to continue service on our Audit Committee.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

Senior Vice President, Integration Management Officer of Lexmark International, Inc. (Retired) | 63 | 2018 | 2021 | ✓Nomination & Governance | None | ✓Business operations ✓Corporate transformation ✓International operations ✓Leadership - former senior executive ✓Supply chain management |

Biography

Linda T. Hollembaek, age 60, recently63, has served as a member of our Board since May 2018. Ms. Hollembaek retired as Senior Vice President, Integration Management Officer of Lexmark International, Inc., a multifaceted technology company that delivers innovative imaging solutions and services to business and consumers worldwide. Ms. Hollembaek served in that role from 2016 until 2017. From 1999 to 2016, Ms. Hollembaek served in other management positions with Lexmark, including Vice President, Global Supply Chain Operations, and Vice President, General Manager of World Wide Services Operations. From 1996 to 1999, she served as Vice President, Sales & Operations, North America, at Danka Services International, one of the world’s largest independent suppliers of office imaging equipment and related services, parts, and supplies. From 1980 to 1996,

13

13

she held various management positions with Eastman Kodak Company and last served as Vice President, Sales and Operations, North America.

11

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

Ms. Hollembaek brings expertise to the Board on supply chain management, corporate transformation, international operations, and Asia-Pacific markets. We believe her knowledge and leadership experience in these areas will enable her to contribute significant value to our Board.

Continuing Directors

The members of our Board continuing in office as Class I Directors, elected to serve until the 20202023 Annual Meeting of Shareholders, are as follows:

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

President and CEO of Manhattan Associates, Inc. | 57 | 2012 | 2020 | None | None | ✓Business operations ✓Business development and corporate transactions ✓Insider’s knowledge of day-to-day operation of the Company ✓Leadership - current CEO ✓Supply chain management ✓Technology and software industries | 60 | 2012 | 2023 | None | ✓Skyline Champion Corporation | ✓Business operations ✓Business development and corporate transactions ✓Insider's knowledge of day-to-day operations of the Company ✓Leadership - current CEO ✓Supply chain management ✓Technology and software industries |

Biography

Eddie Capel, age 5760, has served as our President and Chief Executive Officer since January 1, 2013. Prior to that, beginning in July 2012, Mr. Capel served as our President and Chief Operating Officer. Also, in July 2012, the Board elected Mr. Capel to the Board as a Class I director. Prior to becoming our President, Mr. Capel served as Executive Vice President and Chief Operating Officer since January 12, 2011. Previously, Mr. Capel served as our Executive Vice President—Global Operations from January 2009 to January 2011. In this capacity, Mr. Capel was responsible for the Company’s global product management, research and development, and customer support functions. From January 2008 through January 2009, Mr. Capel served as our Executive Vice President—Global Product Management and Customer Services. From January 2005 to January 2007, Mr. Capel served as our Senior Vice President—Global Product Management and Global Customer Services and from January 2004 through January 2005 as our Senior Vice President Product Management. Prior to January 2004, he held various other positions with the Company. Prior to joining Manhattan Associates in June 2000, Mr. Capel held various positions at Real Time Solutions, including chief operations officer and vice president, operations. He also served as director, operations, with Unarco Automation, an industrial automation/robotics systems integrator. Prior to joining Unarco, Mr. Capel worked as a project manager and system designer for ABB Robotics in the United Kingdom. Mr. Capel also serves on the Board of Skyline Champion Corporation (NYSE: SKY).

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

As our President and Chief Executive Officer, Mr. Capel’s insider and industry perspectives, and knowledge of the Company’s day-to-day operations, enable him to work with the Board and provide essential leadership in strategy development and implementation, allocation of company resources, and communication with the Company’s various stakeholders and audiences.

14

Charles E. Moran

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

Chairman and CEO of Skillsoft Corporation (Retired) | 63 | 2017 | ✓Nomination & Governance | None | ✓Accounting and finance ✓Business strategy and operations ✓Corporate governance ✓Leadership - former CEO ✓Technology and software industries | 66 | 2017 | 2023 | ✓Compensation | ✓Commvault Systems, Inc. ✓Duck Creek Technologies, Inc. | ✓Accounting and finance ✓Business strategy and operations ✓Corporate governance ✓Leadership - former CEO ✓Technology and software industries | |

Biography

Charles E. Moran, age 63,66, has served as a member of our Board since May 2017. Mr. Moran retired as the Chairman and Chief Executive Officer of Skillsoft Corporation, a leading global provider of cloud-based learning and talent management solutions.

12

Mr. Moran held those positions from 1998 to 2015 and remained on as the Chairman from 2015 to 2016. From 1995 to 1997, Mr. Moran served as the President and Chief Executive Officer of NETg, a subsidiary of National Education Corporation, and a provider of computer-based training for IT professionals. From 1993 to 1994, he served as the Chief Operating Officer and Chief Financial Officer of SoftDesk, a leading Architecture, Engineering and Construction/Computer-Aided Design software application company, which was acquired by Autodesk. From 1992 to 1993, he served as the President of Sytron Corp, a data management software subsidiary of Rexon, Inc. From 1989 to 1992, he was Vice President of Sales and Marketing at Insite Peripherals, a manufacturer of floppy disk drives. Prior to joining Insite Peripherals, his experience included various business management positions with Archive Corporation, Florida Data, and Hamilton-Avnet Corporation. From 2009 to 2014, Mr. Moran served on the Board of Directors at Higher One, Inc., a leading payment technology provider for higher education. From 1997 to 2001, he served on the Board of Directors at Workgroup Technology, a client/server product data management solution. Mr. Moran also serves on the Boards of Commvault Systems, Inc. (NASDAQ: CVLT) and Duck Creek Technologies, Inc. (NASDAQ: DCT).

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

Mr. Moran brings expertise to the Board on digital transformation, cloud and SaaS business models, and cybersecurity. A well-rounded executive, Mr. Moran grew up in sales, proved his financial acumen through his time as a Chief Financial Officer, and is recognized as an outstanding strategist and operator. We believe Mr. Moran’s extensive background and knowledge in technology and consulting, and his leadership experience as a corporate executive, make him well-suited to continue to add value to the Company’s Board.

The members of our Board continuing in office as Class III Directors, elected to serve until the 20192022 Annual Meeting of Shareholders, are as follows:

John J. Huntz, Jr.

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

Managing Director of Huntz & Co., LLC | 67 | 1999 | 2018 | ✓Audit (Chair) ✓Compensation ✓Nomination & Governance | None | ✓Accounting and finance ✓Business development and corporate transactions ✓Business operations ✓Corporate governance ✓Leadership - current Chairman | 70 | 1999 | 2022 | ✓Audit (Chair) ✓Compensation ✓Nomination & Governance | None | ✓Accounting and finance ✓Business development and corporate transactions ✓Business operations ✓Corporate governance ✓Leadership - current Chairman |

Biography

John J. Huntz, Jr., age 67,70, has served as a member of our Board since January 1999 and as Chairman of our Board since May 2003. Mr. Huntz has more than 3035 years of private equity, venture capital, and operational experience. Since 2013, Mr. Huntz has served as Managing Director of Huntz & Co., LLC, a venture advisory firm. He also serves on several early stage technology and healthcare venturesventure boards and is an Advisor to Balentine, an Atlanta based wealth management firm. From 2005 to 2013, Mr. Huntz served as Executive Director, Venture Capital Investments, of Arcapita, Inc., and from 2009 to 2013, served as its President. From 2006 until 2010, Mr. Huntz also served as a director and Chairman of the Audit Committee of CardioMEMS, Inc., and then until 2014, he served as its Chairman of the Board. CardioMEMS was acquired by St. Jude Medical in 2014. From

15

15

1994 through 2005, Mr. Huntz worked at the Fuqua Companies, most recently as Managing Director of Fuqua Ventures. Mr. Huntz also served as Executive Vice President and Chief Operating Officer of Fuqua Enterprises, Inc., (NYSE) a public company.

Mr. Huntz’ prior experience includes, from September 1989 to January 1994, serving as Managing Partner of Noble Ventures International, a private equity firm. From 1984 to 1989, Mr. Huntz provided financial and investment management consulting as Director of Capital Resources for Arthur Young & Company, and from 1979 to 1984, he was an investment professional at Harrison Capital, a private equity investment subsidiary of Texaco. Mr. Huntz has also served as a Board member for the National Venture Capital Association, and the SEC’s Small Business Capital Formation Task Force Executive Committee. He founded and leadsis chairman of the Southern Capital Forum, and is an Advisory Board member of the Metro Atlanta Chamber of Commerce, past Chairman of the Georgia Logistics Innovation Council, andis a member of the Board of Georgia Advanced Technology Ventures (Georgia Tech). He also, is on the Piedmont Hospital Foundation Board, and has served in numerous other business and community organizations. Mr. Huntz also is a board member of privately held businesses Bastille Networks (internet security) and Launch Media Networks (fan focused media).

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

Mr. Huntz has over 3040 years of both private and public company operating and leadership experience and has served on numerous boards. In addition, he has extensive financial industry experience through his private equity and venture capital work. We believe Mr. Huntz’s extensive experience, his operational, leadership and finance expertise, and his business and community

13

prominence make him well suited to be our Chairman of the Board and our Audit Committee Chairman. Our Board has determined Mr. Huntz is an “audit committee financial expert” as defined in SEC rules.

Thomas E. Noonan

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

Partner of TechOperators, LLC and Chairman of TEN Holdings, LLC | 57 | 1999 | 2019 | ✓Audit ✓Compensation (Chair) | ✓International Exchange, Inc. | ✓Accounting and finance ✓Business operations ✓Corporate governance ✓Leadership - current Partner ✓Technology and software industries | ||||||

General Partner of TechOperators, LLC | 60 | 1999 | 2022 | ✓Audit ✓Compensation (Chair) | ✓Intercontinental Exchange, Inc. | ✓Accounting and finance ✓Business operations ✓Corporate governance ✓Leadership - current Partner ✓Technology and software industries | ||||||

Biography

Thomas E. Noonan, age 57,60, has served as a member of our Board since January 1999. Since 2008, Mr. Noonan has served as a Partner of TechOperators, LLC, an early stage technology investment firm that he founded. Since 2013, he has served on the Board of Directors of Ionic Security Inc., a data security company funded by TechOperators. Mr. Noonan became Executive Chairman of Ionic Security in January 2016. He is also Chairman of TEN Holdings, LLC, a diversified family office investment company. From July 2013 until November 2015, Mr. Noonan served as Senior Director and General Manager for the EnergyWise product group at Cisco Systems, which in July 2013, had acquired JouleX, a company founded by Mr. Noonan, which was a leading innovator in network-based enterprise management. Since 2010, Mr. Noonan had served as President and Chief Executive Officer of JouleX. Mr. Noonan also co-founded Endgame Security, the leading provider of software solutions to the U.S. Intelligence Community and Department of Defense, where he currently serves on the Board of Directors. From November 2006 until February 2008, Mr. Noonan served as the General Manager of IBM Internet Security Systems, a division of IBM providing information technology system security products and services. Mr. Noonan served as the President and member of the Board of Directors of Internet Security Systems, Inc., since May 1995, and as its Chief Executive Officer and Chairman from November 1996 until its acquisition by IBM in November 2006. Prior to joining Internet Security Systems, Mr. Noonan served as Vice President, Sales and Marketing with TSI International, Inc., an electronic commerce company, from October 1994 until April 1995. From November 1989 until October 1994, Mr. Noonan held high-level sales and marketing positions at Dun & Bradstreet Software, a developer of enterprise business software. Mr. Noonan also serves on the boards of Intercontinental Exchange, Inc. (NYSE: ICE), Children’s Healthcare of Atlanta, and the Georgia Tech Foundation, and isFoundation. He served on the National Infrastructure Advisory Council.Council from 2002 through 2019.

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

Mr. Noonan brings to the Company many years of experience in senior management in the software industry, including as co-founder, Chairman, President, and Chief Executive Officer of a public software company. We believe his entrepreneurial, executive management, and software industry experience is an indispensable resource to the Board. His executive experiences, in which he has dealt with public company compensation plan design and implementation, qualify him well to continue to chair our Compensation Committee. Mr. NoonanNoonan’s familiarity and experience with corporate accounting and finance matters withinat public companies qualify him to continue service on our Audit Committee. Our Board has determined he is an “audit committee financial expert” as defined in SEC rules.

John H. Heyman

Primary Occupation | Age | Director Since | Current Term Expires | Board Committees | Other Public Company Boards | Director Qualification Highlights |

CEO of SnapAV and Partner of Actuate Partners, LLC | 56 | 2016 | 2019 | ✓Audit | None | ✓Accounting and finance ✓Business operations ✓Corporate governance ✓Leadership - current CEO ✓Technology and software industries |

Biography

John H. Heyman, age 56, has served as a member of our Board since May 2016. Mr. Heyman is Chief Executive Officer of SnapAV, a vertically-integrated distributor of audio-visual products for commercial and home use, and has held that position since January 2015. Since 2011, Mr. Heyman has been a partner of Actuate Partners, LLC, a firm which he co-founded in 2011,

1416

and which provides equity funding and consulting to companies in the technology industry, including software, SaaS, and tech-enabled services. Since 2012, he has served on the Board of Influence Health, Inc., which provides software and services to healthcare marketers and clinicians, and served as its executive chair from 2013-2014. From 1995 to 2011, Mr. Heyman was an executive with Radiant Systems, Inc., a leading provider of software, hardware, and consulting services to the retail and hospitality industries. During that period, he was CEO from 2003 to 2011, when the company was sold, and CFO from 1995 to 2002. Earlier in his career, Mr. Heyman served as a public accountant with accounting firm Arthur Andersen, having received his CPA certification in 1985.

Experience, Skills and Qualifications of Particular Relevance to Manhattan Associates

Mr. Heyman has over 20 years of experience in senior and executive management of software enterprises, including under traditional licensing models and cloud-based and other recurring revenue models. While CEO of Radiant Systems, he oversaw the significant growth of Radiant through expansion into new markets and geographies, launching numerous new products, and acquisitions of over 15 companies, both domestic and international. We believe Mr. Heyman’s broad background in technology and consulting, his substantial experience in development and distribution of software and consulting services for the retail industry, and his leadership success as a corporate executive, make him well-suited to add value to the Company’s Board. Mr. Heyman’s public accounting background and his experiences dealing with accounting and finance matters as a public company CEO qualify him well to continue service on our Audit Committee. Our Board has determined Mr. Heyman is an “audit committee financial expert” as defined in SEC rules.

Majority Vote Resignation Policy for Director Elections

The Company’s Bylaws provide that Directors are elected by a plurality of the votes cast. Although nominees who receive the most votes for the available positions will be duly elected, the Board has adopted a Majority Voting Director Resignation Policy (the “Resignation Policy”) applicable to nominees who fail to receive the affirmative vote of a majority of the votes cast in an uncontested election for Directors. The Resignation Policy requires that a nominee not receiving a majority affirmative vote in an uncontested election promptly tender to the Board or its Chair their resignation from the Board and committees on which that Director serves. The resignation may be conditioned upon Board acceptance. If it is not so conditioned, the resignation must specify that it is effective immediately on delivery.

A “majority affirmative vote” means that the votes cast “for” a nominee’s election exceed those “against,” with abstentions and broker non-votes not being considered “votes cast.” You have been provided with options to vote “for” or “against” each Director nominee, and also to “abstain” from voting on a particular nominee. However, neither a vote “against” a Director nominee, nor an abstention, affects whether a Director nominee in an uncontested election is legally elected under the plurality vote standard (provided such nominee receives at least one “for” vote). But a vote “against” a Director is considered in determining whether a Director who is elected has received a “majority affirmative vote” for purposes of the Resignation Policy (as noted above, an abstention does not affect the Resignation Policy-related determination).

If a Director nominee elected to the Board fails to receive a majority affirmative vote and tenders a conditional resignation to the Board, the Nomination and Governance Committee of the Board will consider their resignation, including any information provided by that Director, and within 60 days of the shareholder meeting at which that Director failed to receive a majority affirmative vote, will recommend to the full Board what action to take on the Director’s resignation. The Committee may recommend, among other things, acceptance or rejection of the resignation, delayed acceptance pending the recruitment and election of a new Director, or rejection of the resignation in order to address the underlying reasons for the Director’s failure to receive the majority affirmative vote of the shareholders. The policy provides for the Board to act on the Committee’s recommendation within 90 days following the shareholder meeting.

In considering a conditional resignation, the Committee and the Board may consider those factors they deem relevant, including but not limited to the underlying reasons for the failure of the Director to receive a majority affirmative vote, the tenure and qualifications of the Director, the Director’s past and expected future contributions, other policies, and the overall composition of the Board, including whether accepting the resignation would cause the Company to fail to meet legal or stock market requirements.

Following the Board’s decision, the Company will publicly announce the Board’s decision regarding any conditional resignation. A resigning Director cannot participate in Committee or Board decisions regarding their resignations, except in certain cases where multiple Directors have failed to receive majority affirmative votes, which circumstances are described in the full policy posted in the Investor Relations section of our web site at www.manh.com. The preceding summary of the policy is qualified in its entirety by reference to the full policy.

15

Board Independence and Meetings

The Board currently consists of seven members, all of whom, with the exception of Mr. Capel, our President and Chief Executive Officer, have been determined by the Board to be “independent” as that term is defined under the corporate governance rules of The Nasdaq Stock Market. In assessing the independence status of Mr. Raghavan, who was a co-founder of Manhattan, the Board considered the following as factors in support of his independence: Mr. Raghavan has had no operating involvement with the Company since he retired as an officer and employee in 2002, which far exceeds the three-year post-employment look-back period under the Nasdaq rules; none of the executives with whom he served prior to his retirement as an officer remains with the Company; he is not a party to any related party transactions; and he has not retained a substantial share of ownership of Manhattan—his financial orientation vis-à-vis Manhattan is comparable to Manhattan’s other non-employee directors from the standpoint of independence and governance risk—each of Manhattan’s non-employee directors owns less than one-fourth of one percent of Manhattan’s outstanding equity (on a diluted basis), and Mr. Raghavan owns less than one-tenth of one percent of Manhattan’s outstanding equity (on a diluted basis).

In compliance with Nasdaq corporate governance rules, the independent Directors of the Company conduct regularly scheduled meetings without the presence of non-independent Directors or management. The Board’s standing independent committees also regularly meet without management present. During the fiscal year ended December 31, 2017,2020, the Board held fivesix meetings. All the incumbent Directors attended at least 75% of the aggregate total number of Board meetings and meetings of Committees on which they served that occurred during the portion of fiscal year 20172020 during which each served as a Director. Our Directors are invited to the Annual Meeting of Shareholders, and two Directors attended our 20172020 Annual Meeting.

17

17

The Board maintains three permanent committees: Audit Committee, Compensation Committee, and Nomination and Governance Committee. The Board has adopted charters for the committees, which can be found in the Investor Relations section of our web site at www.manh.com.

The following table provides membership including independencyindependence and meeting information for each committee during 2017.2020.

|

| Committee Memberships |

| Committee Memberships | ||||

Name | Independent | Audit | Compensation | Nomination & Governance | Independent | Audit | Compensation | Nomination & Governance |

Eddie Capel | No |

| No |

| ||||

Edmond I. Eger III | Yes | ✓ | Yes | ü |

|

| ||

John H. Heyman | Yes | ✓ | ||||||

Linda T. Hollembaek | Yes |

|

| ü | ||||

John J. Huntz, Jr. | Yes | Chair | ✓ | Yes | Chair | ü | ||

Charles E. Moran | Yes |

| ✓ | Yes |

| ü |

| |

Thomas E. Noonan | Yes | ✓ | Chair |

| Yes | ü | Chair |

|

Deepak Raghavan | Yes |

|

| Chair | Yes |

| Chair | |

2017 Meetings |

| 4 | 6 | 4 | ||||

2020 Meetings |

| 4 | 6 | 5 | ||||

Audit Committee

During 2017,2020, the Audit Committee consisted of Messrs. Huntz, Heyman,Eger and Noonan. Mr. Huntz serves as Chairman of the Audit Committee. The Board has determined that each member of the Audit Committee meets the additional Nasdaq independence and financial literacy requirements for Audit Committee members, as well as the SEC’s Audit Committee independence standards. Further, the Board has determined that Messrs. Huntz Heyman, and Noonan are “audit committee financial experts,” as defined by SEC rules. Among other responsibilities, the Audit Committee recommends to the Board the selection of our independent registered public accounting firm, reviews the scope and results of the audit, reviews with management our internal controls and periodic financial statements, and approves of the inclusion of our audited financial statements in our Annual Report on Form 10-K to be filed with the SEC. The Audit Committee also reviews and discusses with management and our auditors major financial risk exposures and those steps management has taken to monitor and control those exposures. During the fiscal year ended December 31, 2017,2020, the Audit Committee met four times.

Compensation Committee

During 2017,2020, the Compensation Committee consisted of Messrs. Noonan, Eger,Huntz, and Huntz.Moran. Mr. Noonan serves as Chairman of the Compensation Committee. The Board has determined that each member of the Compensation Committee meets the additional Nasdaq independence requirements for members of compensation committees. The Compensation Committee approves the compensation of our executive officers, including the Chief Executive Officer, reviews compensation plans for our non-employee Board members, officers, and other key executives, and makes recommendations concerning those matters to the Board. The Compensation Committee also administers our equity incentive programs and establishes the terms of our grantedgrants under these plans. During the fiscal year ended December 31, 2017,2020, the Compensation Committee met six times.

Nomination and Governance Committee

During 2017,2020, the Nomination and Governance Committee (the “Governance Committee”) consisted of Messrs. Raghavan and Huntz, and Moran.Ms. Hollembaek. Mr. Raghavan serves as Chairman of the Governance Committee. The Governance Committee recruits outstanding individuals to serve on our Board and recommends to our Board the slate of Director nominees to stand for election at our annual meetings of our shareholders. The Governance Committee also recommends Directors for appointment to our Board Committees and oversees our

16

periodic formal Board and Committee assessment process, including oversight of post-assessment improvements. During the fiscal year ended December 31, 2017,2020, the Governance Committee met fourfive times.

In accordance with the provisions of our Bylaws, our shareholders may directly nominate prospective Director candidates by delivering notice to our Corporate Secretary containing certain information about the nominee not less than 60 days prior to the meeting as originally scheduled, or if less than 70 days’ notice or prior public disclosure of the date of the scheduled meeting is given or made, delivery of notice to the Company not later than the tenth day following the earlier of the day on which notice of the date of the meeting is mailed to shareholders or public disclosure of the date of that meeting is made. Our Corporate Secretary’s address is Manhattan Associates, Inc., 2300 Windy Ridge Parkway, Tenth Floor, Atlanta, Georgia 30339.

18

Shareholders may also recommend a director candidate for consideration by the Governance Committee by submitting the candidate’s name and qualifications to our Corporate Secretary. The Governance Committee haswill consider any candidate recommended (but not adopted a formal policy with regard to consideration of any Director candidate proposedalso directly nominated) by shareholders for inclusion in the Board’s slate. The Governance Committee believes such a policy is not necessary or appropriate because of our shareholders’ ability to directly nominate Directorslate in the same manner it considers other candidates forin the Board.candidate pool, as described below.

In identifying qualified individuals to become members of the Board, the Governance Committee selects candidates whose attributes it believes would be most beneficial to the Company. The Governance Committee (i) considers factors such as the individual’s experience, integrity, competence, skills, and dedication in the context of the needs of the Board, (ii) seeks to recruit from a diverse pool, considering diversity factors such as gender, race, ethnicity, age, and occupation, and (iii) takes reasonable steps to include meaningful representation in the candidate pool of women and minorities. The Governance Committee generally identifies Director nomineescandidates through thetheir personal, business, and organizational contacts and those of existing Directors and management, but also may use a variety of other sources to identify Director nominees, including third-partythrough search firms, counsel, advisors, and from shareholder recommendations. The composition of our current Board reflects diversity in business and professional experience and skills.

In connection with the nomination of Ms. Hollembaek for election to the Board at our 2018 Annual Meeting, an executive search firm contacted the Company and recommended the Company consider whether Ms. Hollembaek might be a good candidate to serve on the Board. The Company did not pay any fee to JamesDruryPartners in connection with their recommendation of Ms. Hollembaek.

Board Leadership Structure

Our Bylaws allow, but do not require, our Board to appoint an officer or a non-executive to the position of Chairman of our Board. Our Board has chosen to separate the positions of Chairman and Chief Executive Officer. Currently, John J. Huntz, Jr., a non-employee independent Director, serves as Chairman and Eddie Capel serves as our President and Chief Executive Officer. We believe separating these positions allows our Chief Executive Officer to focus more on our day-to-day business and other traditional CEO roles, while allowing the Chairman to lead our Board in its fundamental role of providing advice to and independent oversight of management. Our Board recognizes the time, effort, and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as our Board’s oversight responsibilities continue to grow. Although we do not have a policy mandating the separation of the roles of Chairman and Chief Executive Officer, our Board believes that having separate positions and having an independent outside Director serve as Chairman currently is the appropriate leadership structure for Manhattan Associates.

Code of Ethics |

Our Board has adopted a Global Ethics and Compliance Code that is applicable to all members of our Board, our executive officers, and our employees. The Code appears in the Investor Relations section of our web site at www.manh.com. If, in the future, we amend, modify, or waive a provision in the Code, we may, rather than file a Form 8-K, satisfy the disclosure requirement under Item 5.05 of Form 8-K by posting that information on our web site.

Risk Management |

While we believe risk management is the responsibility of every employee, senior management is ultimately accountable to our Board and shareholders for risk management. Senior management is responsible for the day-to-day management of our risks, while our Board, including through its Committees, oversees planning and responding to risks arising from changing business conditions or the initiation of new activities or products. Our Board also is responsible for overseeing compliance with laws and regulations, responding to recommendations from auditors and supervisory authorities, and overseeing management’s conformance with internal policies and controls addressing the operations and risks of significant activities.

Our Board believes that full and open communication between management and our Board is essential for effective risk management and oversight. Our Board receives regular reports from members of senior management on areas of material risk to the Company,

17

including operational, financial, legal and regulatory, strategic, competitive, and reputational risks. Additionally, senior management is available to address any questions or concerns raised by our Board on risk management-related and any other matters.

While our Board is ultimately responsible for risk oversight at the Company, our three Board Committees assist our Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists our Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls, cyber risk, data protection, business ethics and compliance with legal and regulatory requirements, and discusses policies with respect to risk assessment and risk management.corporate compliance. The Governance Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for our Directors, corporate governance, social responsibility, and corporate governance.sustainability. The Compensation Committee assists our Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs, and succession planning for our executive officers.officers, and human capital and talent, including workforce diversity and inclusion.

19

19

In keeping with its responsibilities, the Compensation Committee has evaluated potential risks arising from the Company’s compensation policies and practices for all employees and concluded that any such risks are not reasonably likely to have a material adverse effect on the Company. Among other possible risks, the Compensation Committee considered risks related to the consolidated revenue and adjusted earnings per sharethree components of our 20172020 incentive compensation plans. Those components are Target Revenue (consolidated revenue excluding revenue from cloud-based services, hardware sales and billed travel), new annual contract value from cloud-based services (NACV) and adjusted operating income (AOI) (see complete definitions on page 33). In reaching its conclusion, the Compensation Committee reviewed and considered various factors, including the following:following factors:

| ✓ | Our incentive compensation plans include a short-term annual cash |

| ✓ | Our long-term equity incentives include both performance-based and service-based awards; |

| ✓ | Our short-term annual cash |

| ✓ | Our Compensation Committee reviews and approves performance criteria and related target levels and performance payout amounts for actual results before incentives are paid. |

20

During 2017, eachAt the beginning of 2020, the Company’s non-employee member ofdirector compensation program provided for the Board of Directors receivedfollowing annual cash and equity compensation:

Cash Compensation

|

| Chairman |

| Other Members |

Board |

| $150,000 |

| $50,000 |

Audit |

| 20,000 |

| 10,000 |

Compensation |

| 20,000 |

| 7,500 |

Nomination & Governance |

| 10,000 |

| 5,000 |

We pay the cash compensation in accordance with the Company’s annual compensation program for non-employee directors. In accordance with that program, our non-employee Chairman received an annual cash retainer of $150,000, payable in monthly installments on the first business day of each month. The other non-employee members of our Board each received an annual cash retainer of $50,000 payablecomponent in quarterly installments, on the first business day of each quarter. In additionexcept for all cash compensation payable to those retainers, the Chairman of each of the Audit Committee and the Compensation Committee received an annual cash retainer of $20,000, and the Chairman of the Nomination and Governance Committee receivedBoard, which we pay in monthly installments. Effective April 1, 2020, through December 31, 2020, we reduced the quarterly payments to the non-employee directors by 25% in response to the COVID-19 pandemic.

Equity Compensation

During 2020, the Company granted each non-employee director an annual cash retaineraward of $10,000. Each member$240,000 of a Committee who was not the Committee Chairman received an additional cash retainer for service on that Committee, with those retainers being $10,000, $7,500, and $5,000 for the Audit, Compensation, and Nomination and Governance Committees, respectively. On the date of the 2017 Annual Meeting of Shareholders, each non-employee Director was awarded 3,600 restricted stock units (“RSUs”). That number of RSUs was basedWe granted the awards on a grant value of $168,840. The RSUsMay 13, 2020, and they vest on the earlier of the first anniversary of the grant date of grant or the next Annual Meeting of Shareholders provided thatso long as the Directordirector remains in continuous service on the Board through that vesting date. We determined the number of RSUs granted based on the closing price of the Company’s Common Stock on the date immediately prior to the 2020 Annual Meeting of Shareholders ($69.74 per share on May 13, 2020), resulting in each non-employee director receiving 3,442 RSUs ($240,000 / $69.74 = 3,442). Upon vesting, we will settle each RSU will be settled with one share of Common Stock.

18

The following table sets forth, for the year ended December 31, 2017,2020, the total compensation earned bypaid to our non-employee members of the Board of Directors.directors.

2017 Director Compensation Table | ||||||||||||

2020 Director Compensation Table | 2020 Director Compensation Table | |||||||||||

Name (1) |

| Fees Paid In Cash |

| Stock Awards(2) |

| Total |

| Fees Paid In Cash |

| Stock Awards(2) |

| Total |

John J. Huntz, Jr. |

| $182,500 |

| $168,840 |

| $351,340 |

| $148,281 |

| $240,045 |

| $388,326 |

Thomas E. Noonan |

| 80,000 |

| 168,840 |

| 248,840 |

| 65,000 |

| 240,045 |

| 305,045 |

John H. Heyman |

| 60,000 |

| 168,840 |

| 228,840 | ||||||

Deepak Raghavan |

| 60,000 |

| 168,840 |

| 228,840 |

| 48,750 |

| 240,045 |

| 288,795 |

Edmond I. Eger III |

| 57,500 |

| 168,840 |

| 226,340 |

| 48,750 |

| 240,045 |

| 288,795 |

Charles E. Moran |

| 34,148 | (3) | 168,840 |

| 202,988 |

| 46,719 |

| 240,045 |

| 286,764 |

Brian J. Cassidy (4) |

| 23,867 |

| - |

| 23,867 | ||||||

Linda T. Hollembaek |

| 44,688 |

| 240,045 |

| 284,733 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____________

(1) | Mr. Capel, our employee Director, does not receive any compensation for his service as a member of the Board of Directors. Mr. Capel’s compensation during |

(2) | This column represents the aggregate grant date fair value of the |

|

|

|

|

Our Compensation Committee recommends to the Board our non-employee directors’ compensation for the Board’s determination. Our Compensation Committee periodically has its independent compensation consultant review the compensation structure and levels for our non-employee directors, including by analyzing director compensation at the same peer companies used in evaluating executive compensation. In January 2020, the Board, on the recommendation of the Compensation Committee, and following consultation with the consultants, increased the annual equity award to the non-employee directors from $200,000 in 2019 to $240,000 in 2020. Based on the independent compensation consultant’s analysis, the Board considers the non-employee directors’ compensation to be appropriate and consistent with practices of comparable companies. See “The Role of Compensation Consultant” on page 29 for additional information regarding the Compensation Committee’s independent compensation consultant during 2020

21

21

The following table summarizes the equity awards made to the non-employee members of our Board that were outstanding and unvested as of December 31, 2017.2020.

Non-Employee Directors' Outstanding Stock Awards as of December 31, |

| |||

Name |

| Number of Shares Subject to Restricted Stock Units |

| |

John J. Huntz, Jr. |

|

|

|

|

Thomas E. Noonan |

|

|

| |

|

|

| ||

Deepak Raghavan |

|

|

|

|

Edmond I. Eger III |

|

|

|

|

Charles E. Moran |

|

|

| |

3,442 |

| |||